Family Saving Tips

Within the family, it is very important to develop unity and teamwork. This strengthens family bonds and helps children to develop positively. Saving on the family is a great idea that can provide a good education for your children, protecting everyone’s financial future.

However, to effectively instill the value of savings in our children, we must obviously start to put some actions into practice. We cannot teach one thing and, with our example, show something different. Remember that our children will imitate what we do much sooner than we can imagine.

Advantages of saving in family

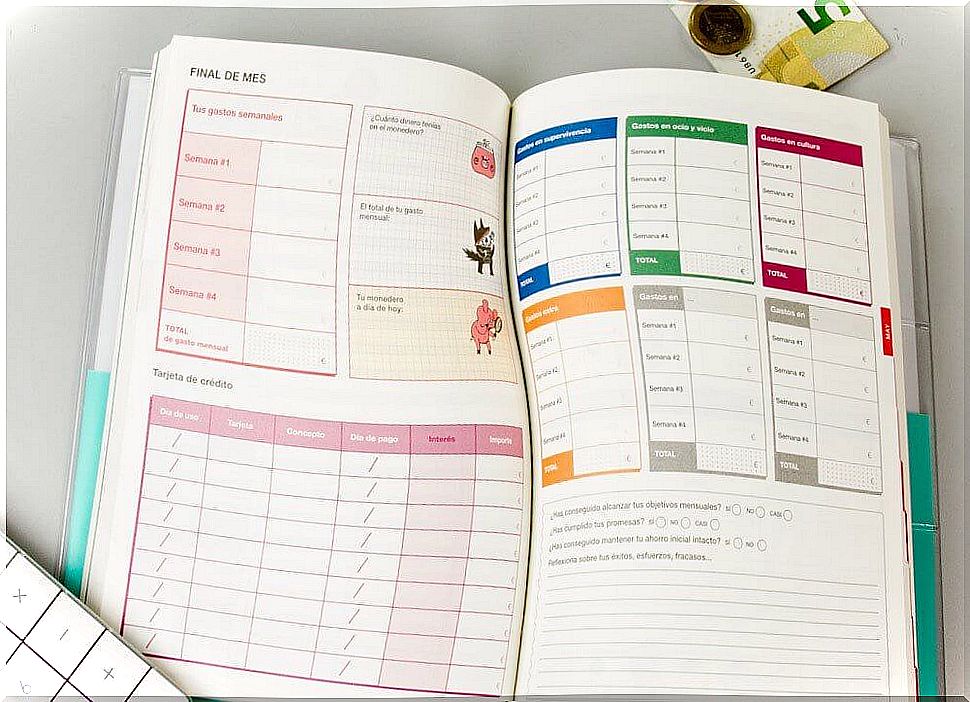

Understand that there is a difference between family savings and what is known in economics as family savings. The first refers to the simple voluntary act in which a family decides to save money in a single account to cover immediate family expenses or for a certain period of time.

On the other hand, family savings simply refers to the difference between the monthly income and the expenses that a family has at the same time. Let’s see what are the advantages of saving with the family:

- Saving part of the family income allows the formation of capital, which in the future will give the option to acquire family assets.

- For children, it helps to develop good money-saving habits.

- It allows for family bonding by developing goals and targets together.

- It helps family members to strengthen the feeling of belonging to a group, which is fundamental for the proper social development of the youngest.

- With family savings, each member will make an effort to fulfill the other elements of savings, which are budgeting and reducing expenses.

During childhood, the capital that can be saved will come directly from the provider(s). However, it is valid to come indirectly through the children, saving what is left of what they take to school, for example. The idea in this case is to develop the habit in the younger ones.

Tips to save with the family

Remember that during the duration of savings, one of the intrinsic goals is to be able to cultivate a good habit of saving among family members. For this, clear rules, objectives and goals must be established in the short, medium and long term.

In addition, we seek the satisfaction of, in the future, being able to invest in a good or service that benefits the whole family. But where to start? Well, take note of these practical tips for saving with the family.

Start teaching youngsters from an early age

Involve the little ones simply, depending on their age. The younger children in the family will enjoy saving on a piggy bank. Motivate them, if applicable, to deposit the coins that accumulate during the day.

There are many bank agencies and credit unions that allow you to open accounts for children that are managed by their parents. If children are of school age, they can benefit from this type of account. It can be exciting for them to have their own laptop and see how their savings grow as they contribute.

Set goals to save as a family

It is important that, as a family, you come together to develop a savings plan. This is basically done by answering questions like:

- What are our goals?

- How much money do we need to achieve these goals?

- How much time will we save money to achieve these goals?

- How much should we save in the week or month?

Create a savings plan together

Remember that family savings are the parents’ responsibility. However, when saving as a family, we involve all members. Just as you would with a regular savings account, to save money as a family, it’s a good idea to draw up a savings plan. To do this, ask the following questions:

- Why do we need to save as a family?

- What needs exist in the family and what are the most immediate?

- What are our short, medium or long term goals?

Make agreements to reduce expenses

All the tips on saving resources and energy apply to parents as well as children, obviously in different ways. For example, everyone can help reduce the cost of electricity, or things as simple as eating all the food on your plate. If you go to the supermarket together, bring a list and follow the list, although this is difficult for the younger ones.

We invite you to put these tips into practice to start saving as a family to build a more stable financial future. Save, reduce expenses and generate change.